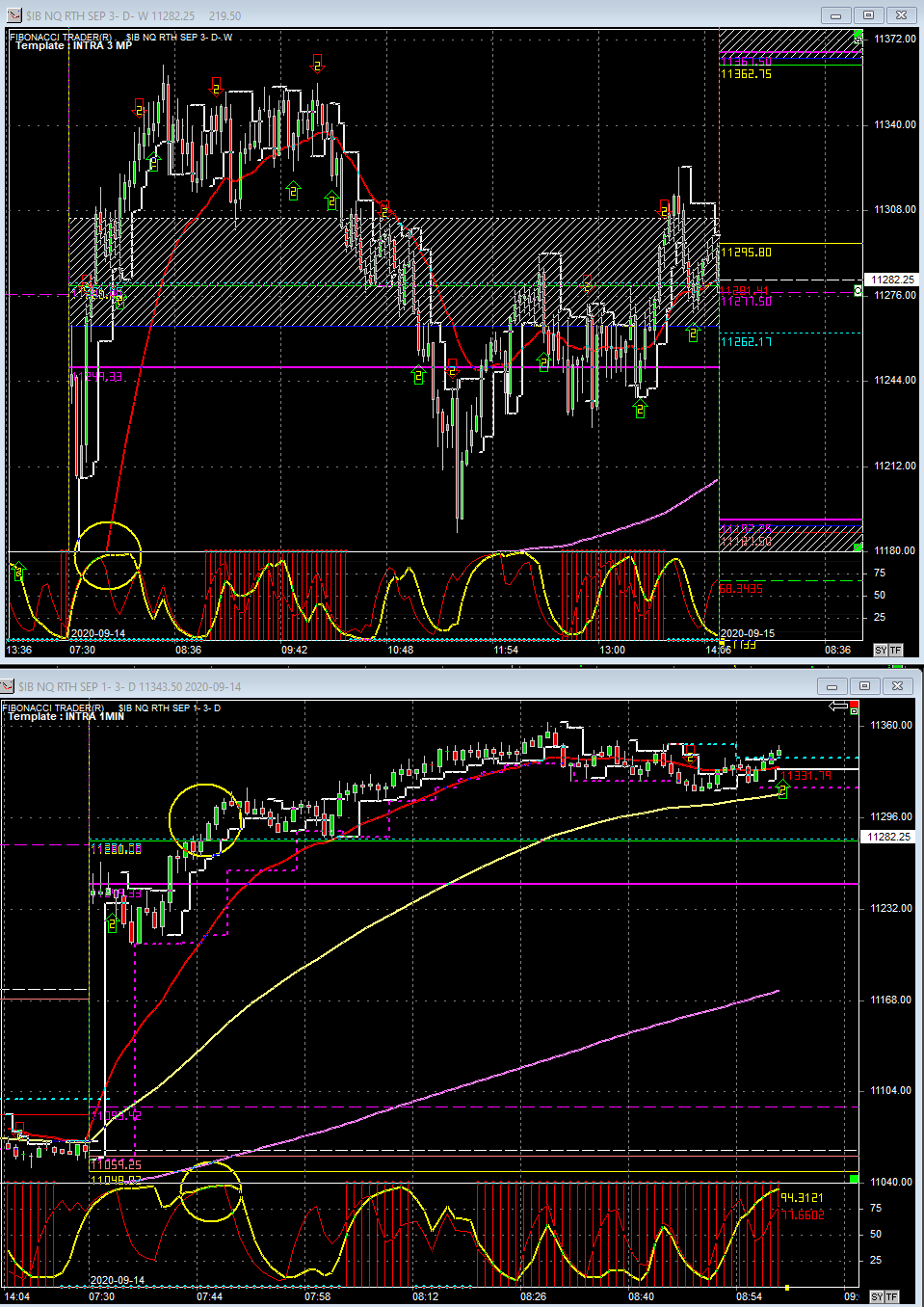

Indices gapped up this morning. Looked to short NQ into resistance at the dynamic pivot and previous day’s high which were both within the Fibonacci Zone (FZ) (shaded area). Stochastics were overbought on all time frames. Shorted 1@11287.50. Added 1@11306.50, the top of the FZ and another at 11311.75 with a tick divergence and a 100 point swing from the low. Scaled one at 11300 to reduce risk. Exited the remainder when the 30 second Stochastic cycled back to oversold and price couldn’t break below 11300 with conviction. Ended up with a loss of $223. If I would have waited a few more minutes, I would have been able to exit for a profit. But once stochastic was oversold and price couldn’t even get to the 21EMA red line (bottom chart) more often than not that is not a good sign. This indicates strong momemtum and one would expect new highs. In hindsight, when the rest of the indices broke through their respective FZs (NQ was lagging), I should have waited to enter at 11311.75 instead of shorting earlier. Monday’s are always tricky. I was hoping for a consolidation after the gap up to buy. Instead we got a very small pullback only to rip higher. And once the rip happened there wasn’t a pullback to get long.