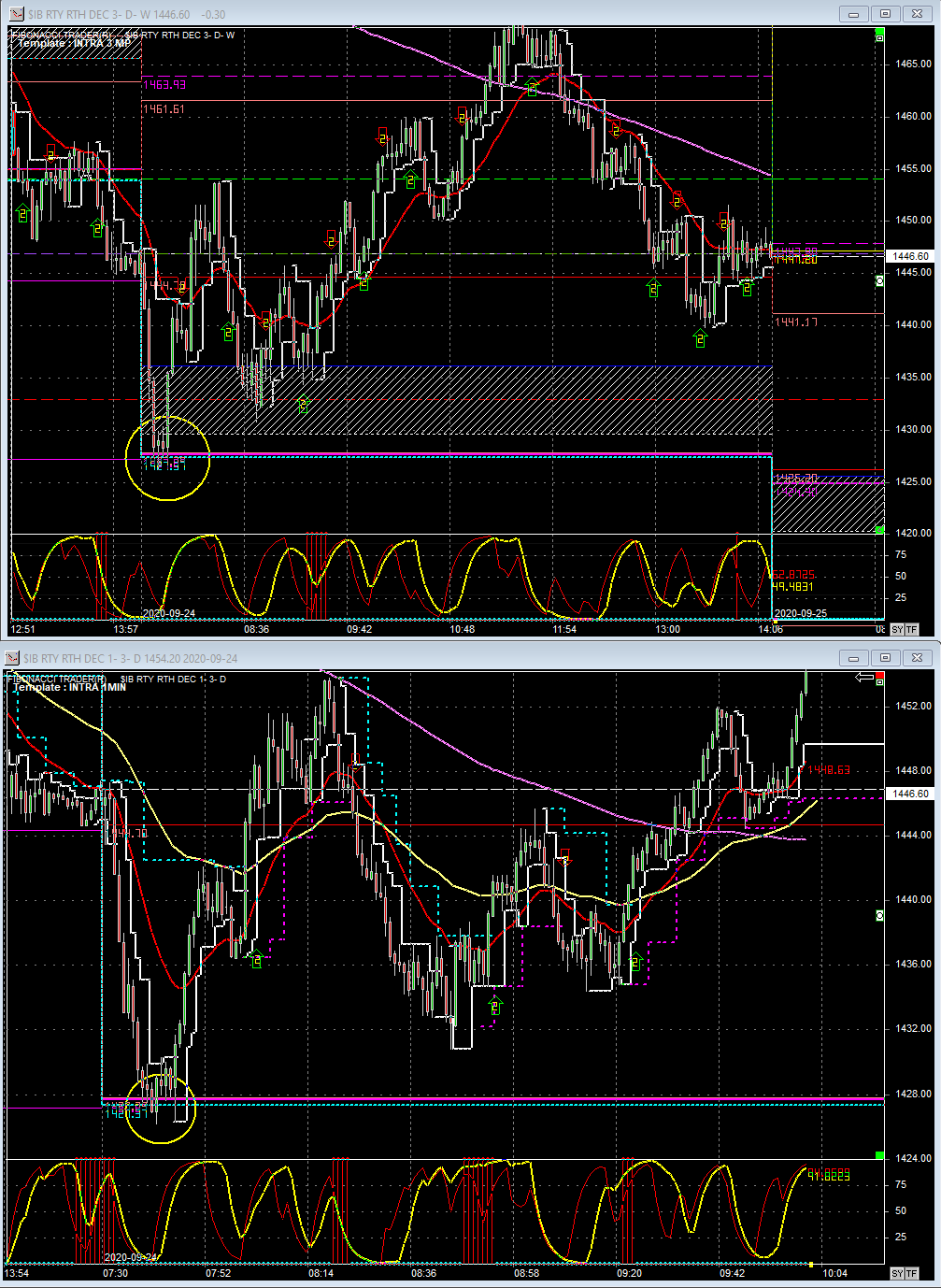

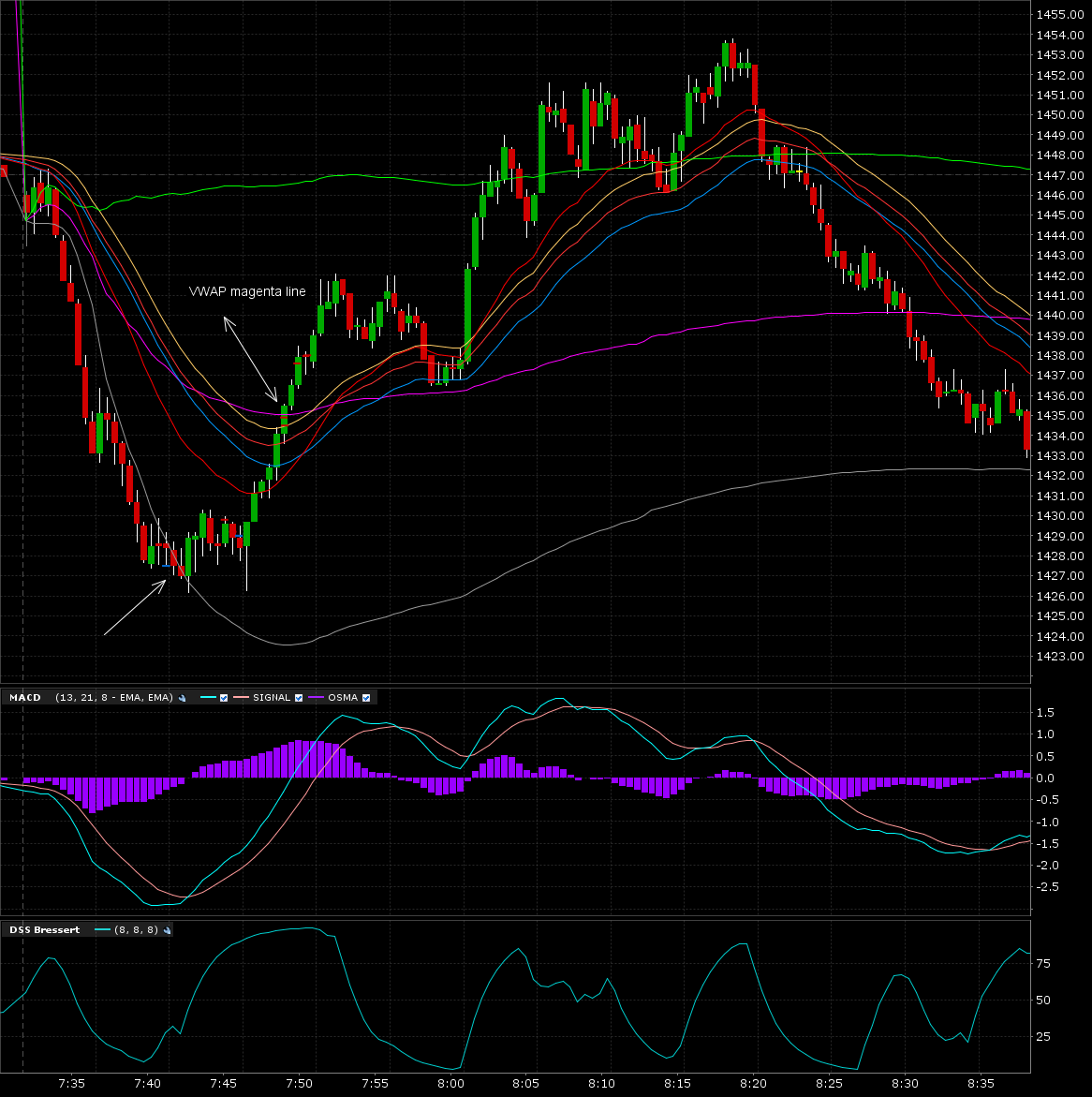

I was looking for a potential bounce this morning after a big down day yesterday. RTY should have strong support at around 1427.5. There was a confluence of 3 levels. Also the initial downswing from the open was roughly 20 points which usually for RTY signals exhaustion. Stochastics on all three timeframes were oversold as well as a tick divergence. Bought 4@1427.5. I was expecting a strong bounce immediately. Instead the anticipated reversal was anemic to put it lightly. 30 second stochastic cycled back to overbought and I decided to scale out at 1429.20 and 1429.80. Had the feeling we would retest the lows or go lower and I could rebuy at better prices. So I exited the remainder at 1429. Or so I thought. Instead, much to my chagrin, I mistakenly hit the buy button and ended up being long 4 contracts. I like to call these kind of mistakes, operator errors. I didn’t even realize I was long until after more than a minute had passed when I happened to glance at my trade log. Usually I go immediately flat if I realize I’ve made an operator error. By the time I figured out my predicament, RTY dipped lower. I was watching the other indices and they had bounced hard off their support levels and were heading higher and because of this, I stayed in the position thinking RTY would follow. Thankfully it did. Exited 2@1434.50 around the VWAP (magenta line on 30 second chart). Sold the rest at 1437.8 and 1438 when we approached the 21 EMA on the 3 min 24 hour chart(not shown). Also wanted to be out before the 8AM release of existing home sales. RTY dipped just before the release and rocketed higher when the number was better than expected. After all said and done, made a profit of $1775.

2 thoughts on “Operator Error”

Comments are closed.

Nice bit of luck recovering from an unforced error but as they say never confuse brains with a bull market! What made you trade RTY vs NQ? Which indices do you normally follow?

Howdy Trader Joe,

I track four future indices:ES, NQ, YM, RTY. Which one I decide to trade depends on which one triggers. For this day, RTY and ES were setting up in unison. I chose RTY since the initial downswing was larger from the open and I expected a bigger bounce. In hindsight, ES was the better trade since it actually moved higher off the lows. Unlike the RTY, it never retested the lows after the initial entry plus the trade would have been more profitable as well. I wish I didn’t have a brain because I would probably be better off financially just buying the dip with reckless abandon. From a trading standpoint I just trade off the chart. I actually prefer the short side since shorts more often than not pay off quicker than longs. There is definitely an underlying bid in the market. This is a direct result of the Federal Reserve’s interest rate policy. The stock market is the only game in town with respect to positive returns. As they say in Wall Street, “Don’t fight the Fed.”