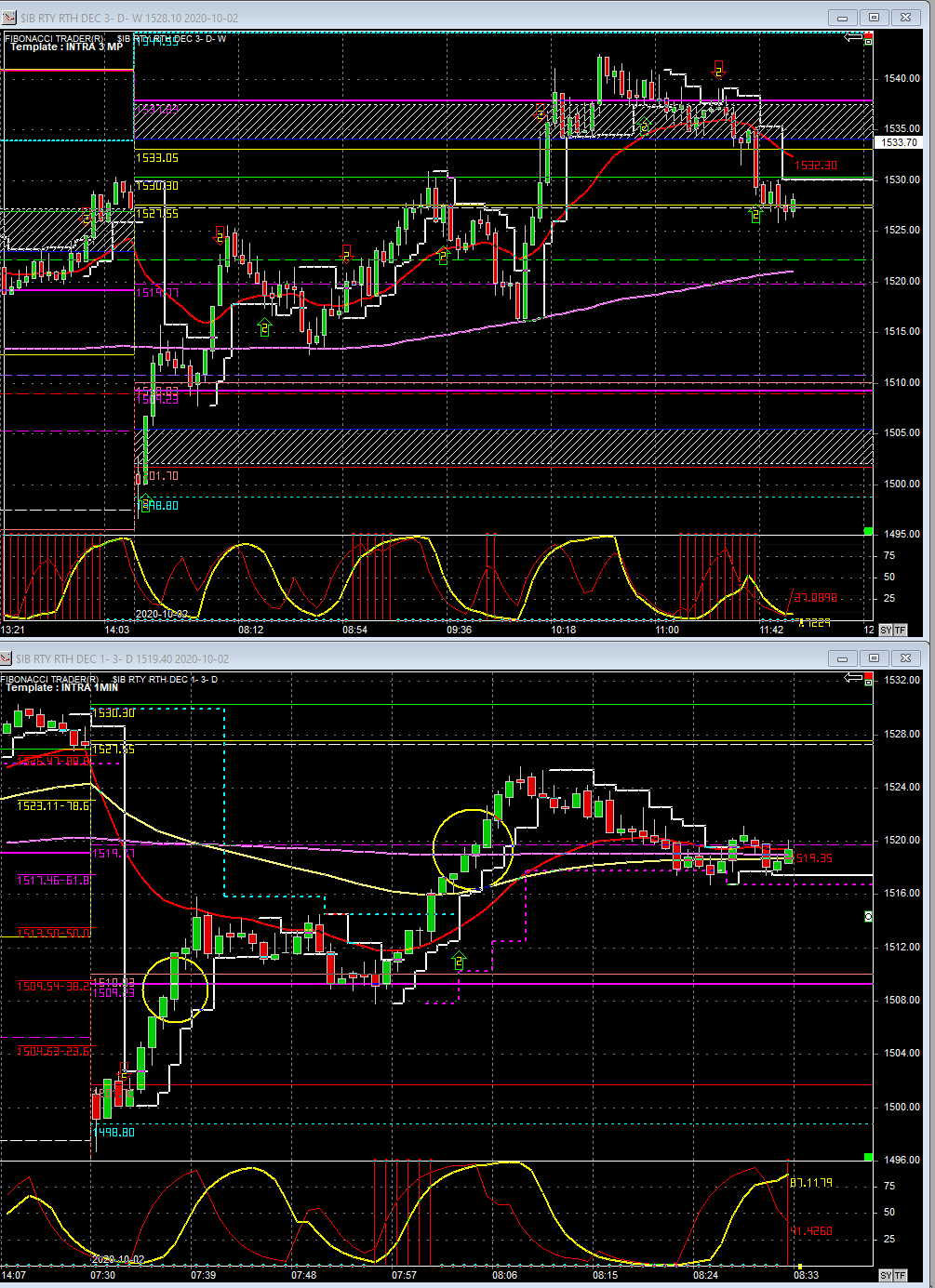

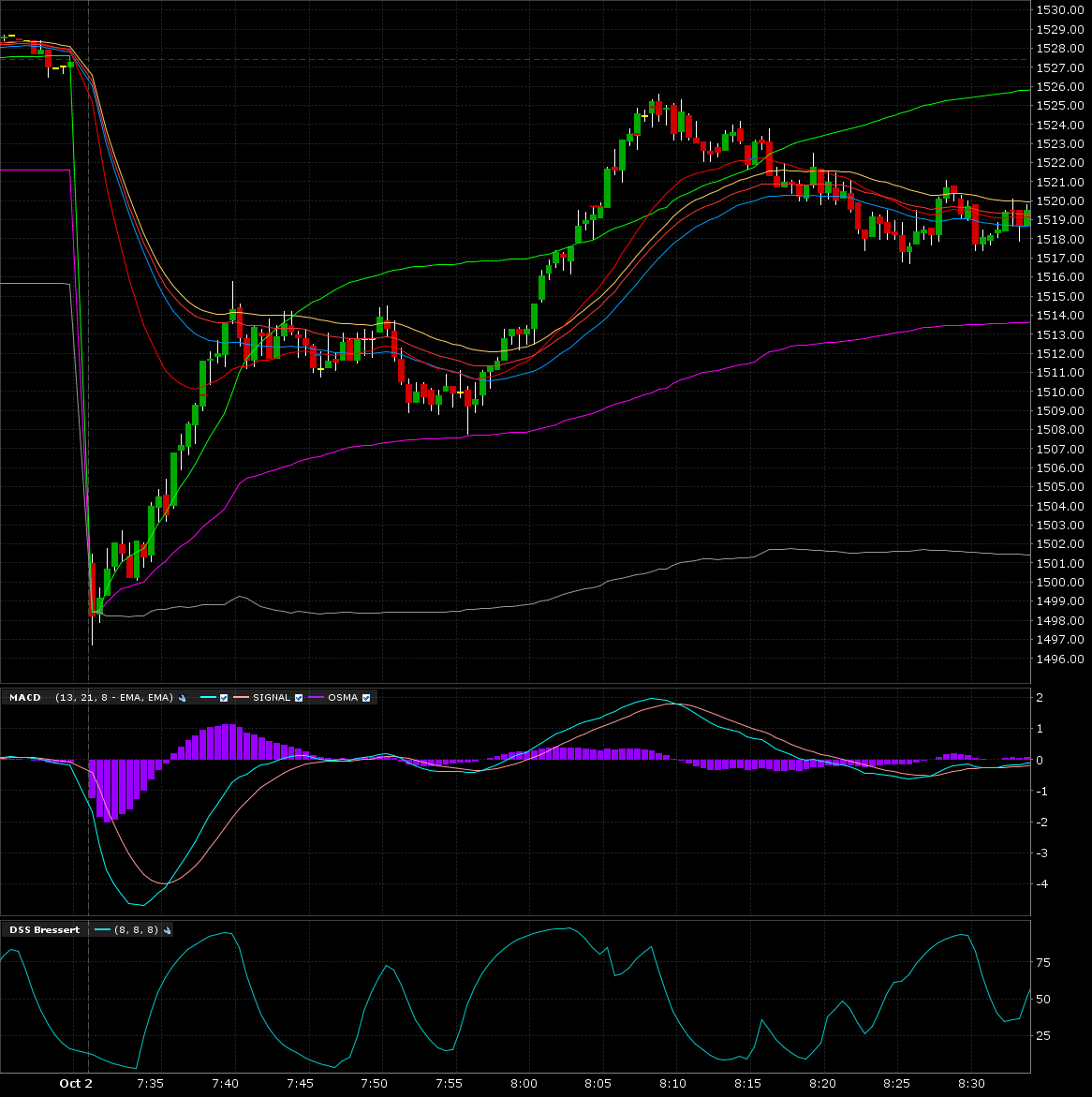

Took two short trades today and got bitch slapped by the short squeeze off the gap down open due to the news that POTUS has COVID. How is that possible? We all know COVID is fake news. I digress. Had 3 levels of resistance around the 1510 area in RTY. Shorted 4@1509.7. Blew through my stop on the way to a high of 1515.80. Exited on the retrace back down at 1511.8 when the 30 second stochastic became oversold. Took another short at 1519.70 at the pivot and it being around a 20 point swing from the low. Doubled up at 1523.5 and added a final contract at 1524.90 when tick divergence appeared. Exited 9@1522.20 when 30 second stochastic got oversold. Total loss of $585. My worst days are when I get caught in a short squeeze. Today is very similar to a day in March where I got crushed shorting a rip up from a gap down in RTY. At least today I called it quits after I went 0 for 2. If I could replay the day, I wouldn’t have taken the first short. RTY was the strongest of the 4 indices and I didn’t have oversold stochastic on either the 1 or 3 minute. Although reversals can be profitable, I need to focus on trend trades. Less stress as well as way easier to manage the trade.