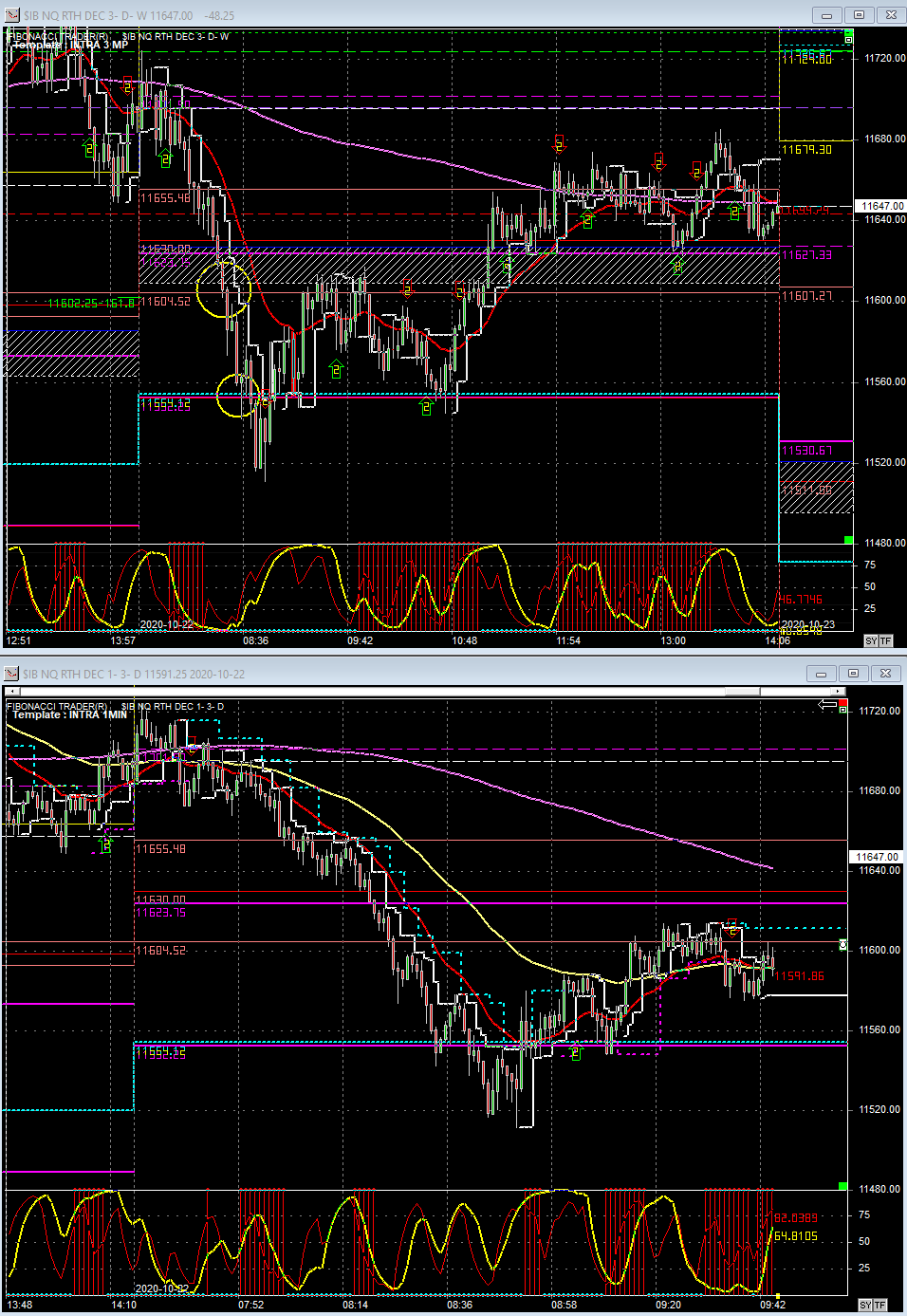

Made 3 trades today trading MNQ all to the long side. Batted 1 for 3 and ended with a loss of $186. Price action off the open was strong with a large delta on the first 3 min candle as it broke the pivot of 1701.50. Bought the pullback off the 30 second chart. Long 5@11701.50. Looked promising as it bounced up but got stopped out at 11691.50 as momentum quickly reversed.

Took a long off 11602.25 as price hit multiple levels of support (bottom range of the Fibonacci Zone, standard deviation low, 1.618 extension, and 11600 round number support). Never even saw daylight. Stopped out within 40 seconds at an average price of 11581.80. You know the market is weak when it doesn’t even bounce a little off multiple levels of support.

Tried a final long at 11554.75 at the S2 pivot and Dynamic extreme daily low. Got a bit of a bounce but still rather anemic considering the down swing was around 180 points. Took 3 off at 11567.75 as the 30 second stochastic got overbought. Exited the rest at 11573.5, 11570, 11570.75 as price started to stall at the 21EMA on the 30 second chart.

Not a good day by any means. I was really surprised how I got stopped out so quickly on the second trade. Fortunately I was trading micros so the damage was manageable. NQ is the most volatile of all the indices and to mitigate risk, I prefer to use micros especially when taking a reversal trade.