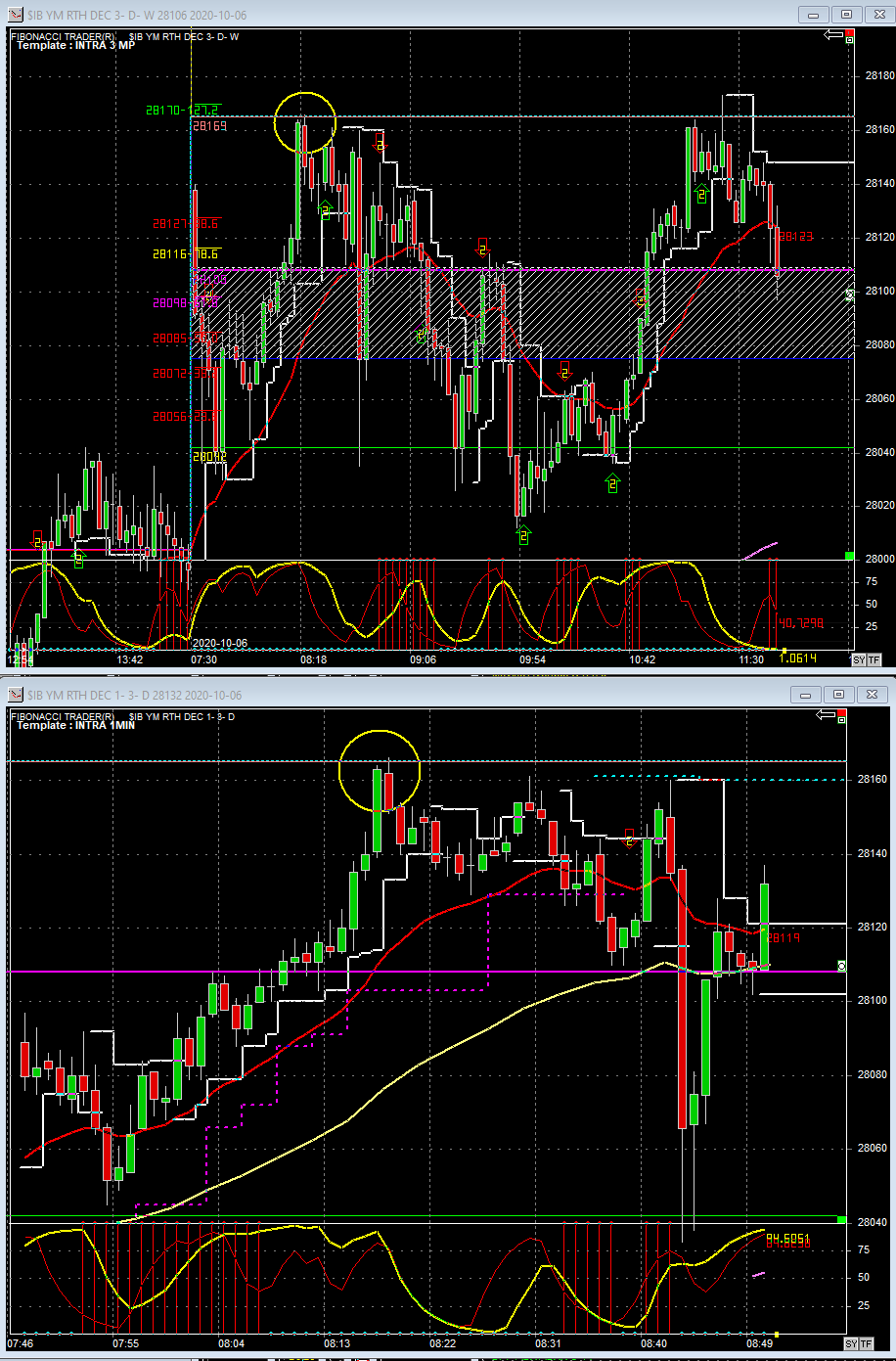

After a big up day yesterday, I expected more rotational action today. Shorted 2 YM@28164 where there were three levels of resistance, one of them being the 1.272 extension from the previous swing low. Many times when price reaches the 1.272 or 1.618 extension, it signals a potential reversal. Exited 1@28137 when the 30 second stochastic went oversold. Exited final contract at 28143 when the 1 min stochastic went oversold. It bounced up right after almost to retest the highs before falling and testing the 21ema on the 3 minute at around 28114. This is the level I was hoping we would hit before the stochastics got oversold. The initial rejection from entry looked promising but unfortunately there wasn’t enough downside momentum to hit target. Ended up making $232.

Traders fall into two camps. They either hate giving up profits or hate seeing the loss of potential gains by exiting too early. I hate giving up profits. I feel this approach is the one to use when trading reversals. You are going against the trend so one has to be diligent in taking profits when you have them. When the momentum is strong, profits can evaporate quickly with the continuation of the trend. When you are trading with the trend, the reverse holds true. You want to hang on to your winners as long as possible to maximize potential profits.